C-Span is a wonderful thing. Just listen or watch - The House Oversight and Government Reform Committee hearings yesterday brought in some interesting statements from CEO's and Presidents of Bank of America, JP Morgan/Chase and others.

As I reported in my article WALK AWAY FROM THE PROPERTY - STRATEGIC MORTGAGE DEFAULTS GROW TO 26%, that figure is now updated by the University of Chicago and Northwestern University researchers for the previous figures - a year later the strategic default rate is up another 10%!

Why is this happening? Industry leaders blame the government programs. The HAMP program has 800 specific requirements for the borrower - 800 !!! No wonder it takes 4 to 6 months for a person to go from trial modification to permanent modification. Numbers for successful conversions under HAMP is running about 10% of trial modifications.

What makes a borrower ineligible for HAMP or other (proprietary) modification programs of the lender? Testimony today said that government regulations of easy credit made the banks make loans to people that could not afford the mortgages they got - and this is now the end result - these borrowers still do not qualify even for a modification! A big reason for rejection - trial mod recipients don't pay the reduced payments or don't provide necessary documents.

Modification requirements always now require real, as opposed to "stated", income revelations. Many borrowers don't give the required information on their "real" income to qualify for the modification. Why? Testimony suggested being afraid of the IRS, or being intimidated because of perhaps false documents in the beginning, are other reasons.

I loved the comments from Rep Elijah Cummings - his staff sent documents on behalf of constituents to a lender and those documents got "lost" - several times! And he had proof that payments were made to the lender and the lender failed to acknowledge the payment even when the Congressman's staff showed the lender the cancelled check.

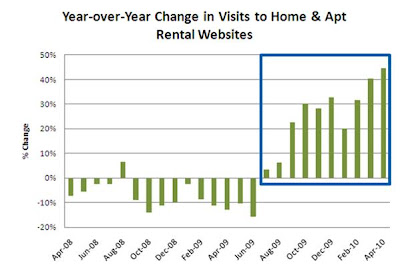

When asked what is the solution - lenders said there needs to be a "dignified transition". What is THAT? A "dignified transition" is making homeowners into renters! " Not all homeowners should be owning a home". Well, I cannot disagree with that, but it just does not sit well. So they suggest that short sales be the "dignified solution".

Maybe Washington is listening and even feeling the pain. Keep watching and tell your Washington representatives what you think needs to be done.

Copyright 2010 Richard P. Zaretsky, Esq.

Be sure to contact your own attorney for your state laws, and always consult your own attorney on any legal decision you need to make. This article is for information purposes and is not specific advice to any one reader