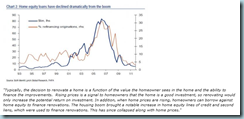

I just finished going over NAR’s 2012 Investment and Vacation Home Buyers Survey,which covered existing- and new-home transactions in 2011. The report showed that investment-home sales surged an extraordinary 64.5 percent to 1.23 million last year from 749,000 in 2010. Vacation-home sales rose 7.0 percent to 502,000 in 2011 from 469,000 in 2010. Owner-occupied purchases fell 15.5 percent to 2.78 million.

A recent CNBC article (excerpted below) notes the risk of what the NAR report exposed:

While nearly half of investment buyers said they were likely to purchase another property within two years, housing and mortgage analyst Mark Hanson calls them a “thin cohort” and worries that they add ever more volatility to the current housing recovery.

“They are fickle and volatile. They will go away on the slightest of conditions changes. They also won’t chase prices higher or buy new homes from builders. Lastly, without the heavy flow of distressed supply, there is no U.S. housing market recovery. Distressed sales ARE the market,” says Hanson.

Remember…investment is all about the numbers. Change anything where the numbers aren’t as attractive — even something as minor as HOA fees — and investor demand dries up. To an investor, a house is not a home: it’s cashflow + equity. These investors analyze a house in exactly the same way they would analyze a bond or a stock.

Even if house prices remain stable, if rent rates drop, that changes the investment equation. Now the investor isn’t interested even if the price remains at $200K, because his cashflow projections are all out of whack.

Any hint of rent regulation, and an investor would have to be a fool, politically connected, or pay such a low price that he’ll still make money under rent control, to even consider buying rental properties.

Stan Humphries, from Zillow recently said, “some markets have likely seen their bottom (think Washington DC or Phoenix, both of which we forecast to see appreciation in 2012),but nationally, the bottom in home values is some way off. Your cautions all fall in line with exactly what we at Zillow have been observing – high percentages of cash buyers, investors flocking to the market to take advantage of rising rental rates (with rents up 3% nationally during 2011). We’re forecasting the national bottom in home values for 2013, and we expect that most large markets will continue to see depreciation throughout 2012. We introduced a formal forecast in our Q1 reports. (You can see the Zillow report here: http://bit.ly/yRwRj7.

As I always tell my clients…”take every news report you read/see/hear with a grain of salt”. Most agencies who put out the stories have an agenda to promote…and most reporters no longer look into the details of any story they are given.

The recent great housing news…(i.e. sales/prices up), is being driven by a very narrowly motivated segment of buyer: “investors”. If there is any small shift in the tax laws benefiting income properties, rental rates; any reduction of cash-on-cash return or after tax return…you can bet the investors will be back on the sidelines.

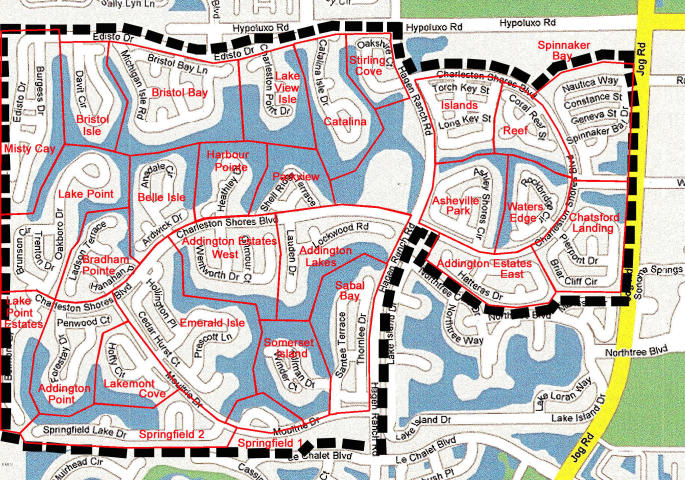

Call me directly and lets talk about how all of this (and more) affect/influences your real estate selling or buying goals.

Thanks for reading…Steve Jackson

561.602.1258