- Epic supply backlog

- A secular shift from plunging demand via habitation patterns, as more and more simply opt to live with their parents

- More and more are forced to rent

- Home prices will slide ever more as the American Dream of home ownership is forgotten, leading to even less wealth extraction via home equity loans

- Which all means there is no hope for a long, long time…not at least until 2020

1) It's safe to sell your home again:

The Realtors' group's chief economist, Lawrence Yun, opted to look on the bright side of the report -- sales were up 5.2% year-over-year. "We have seen nine consecutive months of year-over-year sales increases," he said. "Existing-home sales are moving up and down in a fairly narrow range that is well above the level of activity during the first half of last year."

2) Housing recovery still sputters:

NEW YORK (CNNMoney) -- The housing market continued to struggle in March, despite low home prices and record low interest rates, an industry report revealed Thursday.

Sales of existing homes fell 2.6% compared with a month earlier, to an annualized rate of 4.48 million homes, the National Association of Realtors said. Gus Faucher, a senior economist at PNC Financial, called the report disappointing. "We were expecting an increase," he said. "We need a turnaround to help the economy recover.

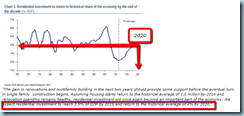

3) No Housing Recovery Until 2020 In 5 Simple Charts

Every day (for the past 3 years) we hear countless fairy tales why housing has bottomed and will improve any minute now. Just consider the latest kneeslapper from that endlessly amusing Larry Yun of the NAR, uttered just today: "pent-up demand could burst forth from the improving economy." Uh, right. Here's the truth - it won't and here is why, in 5 charts (below) directly from Bank of America, so simple even an economist will get it.

The so called “recovery” is about to get impaled by a tsunami of foreclosures with prices dropping a further 5-10% - recovery will take years with the added bonus that those who have been living rent free are about to direct some of that windfall of "disposable income" to actually paying for shelter…watch how that effects the overall economy!

As always…thanks for reading!

Steve Jackson

561.602.1258