7/30/10

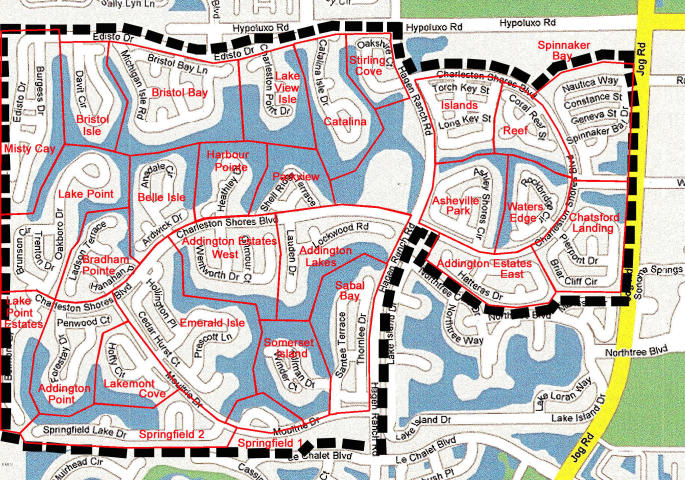

A new property we are marketing...

If you would like to see some of the other cutting edge marketing we employ to get our clients top dollar...even in today's difficult market...please call me now at 561-602-1258.

Thanks

Steve

7/24/10

7/23/10

Inflation? Deflation?

It would seem that everyone is right...here is the best and easiest to explain/understand definition/comparison-contrast of inflation and deflation:

I've seen some quotes equating to deflation as the things you own, and inflation as the things you need. Close, but the real explanation is more like this:

Prices declines are occuring in goods/services sectors backed by debt resulting from contracting credit...things that you would normally use a loan/credit to buy (deflation). Price increases are occurring in goods/services sectors acquired with money resulting from increasing money supply (inflation), (things like food, utilities, gas for the car, etc ).

Ben can print money 'til the cows come home, showering every citizen with $10k, $100k, $1m per year/quarter/month. All that will happen is a direct escalation in prices of assets not backed by debt. Price increases for items backed by debt will not resume/recur until there is an underlying organic demand for credit and a corresponding easing in credit terms (inflation). That is, the so-called final (ie private) demand.

And there you have it...

7/20/10

HAFA explained

The Home Affordable Foreclosure Alternatives (HAFA) Program is a government-sponsored initiative led by the US Treasury Department, administered by Fannie Mae with Freddie Mac as compliance agents, and executed by participating lenders to help homeowners avoid foreclosure, specifically through short sales or deeds-in-lieu.

Who can participate in the HAFA program?

The participating servicers must assess a borrower for HAFA if they request to short sale or deed in lieu under the terms of HAFA. They must also consider a homeowner for HAFA within 30 days of not qualifying for a HAMP (Home Affordable Modification Program) modification, having not successfully completed a HAMP trial period, or having missed at least 2 consecutive payments on a HAMP modification. If a homeowner had asked the servicer to allow them to short sell under the terms of HAFA, the servicer is required to first offer them a loan modification or retention program first.

Can sellers trying to do a HAFA short sale also be asking for a HAMP modification?

The two cannot be done at the same time. It is a requirement of HAFA that a homeowner is not participating in a HAMP program.

Does the homeowner have to live in the property to be considered for HAFA?

“The property is the borrower’s principal residence, except that the property can be vacant up to 90 days prior to the date of the Short Sale Agreement (SSA), Alternative Request for Approval of Short Sale (Alternative (RASS) or DIL Agreement if the borrower provides documentation that the borrower was required to relocate at least 100 miles from the property to accept new employment or was transferred by the current employer and there is no evidence indicating that the borrower has purchased a one- to four-unit property 90 days prior to the date of the SSA, Alternative RASS or DIL Agreement.” [From the Supplemental Directive 09-09]

What loans are not eligible for HAFA short sales?

Fannie Mae, Freddie Mac, FHA, or VA

What lenders are participating in HAFA?

As a rule, lenders already participating in the Home Affordable Modification Program (HAMP) are participating in HAFA. For a full list of servicers participating in HAMP, visit Making Home Affordable Participating Servicers List.

When does HAFA expire?

HAFA is set to expire December 31, 2012. Like other government initiatives, if the program is successful, it may be extended.

I heard that Approvals only take 10 days. Is that so?

This is a misconception and a truth. HAFA speeds up the short sale process by putting in distinct timelines. One such time-line is servicer response to a completed application no later than 10 days after submission. The longest amount of time you should expect a HAFA short sale to take is 5 months. At the servicer’s discretion, the program can be extended up to 12 months.

Do HAFA short sales require an agent list the property?

YES. All HAFA short sales must be listed by an agent.

How is HAFA different from a regular short sale? There are quite a few issues that differentiate a HAFA short sale from a non-HAFA short sale, including: 1) set timelines, 2) pre-approved selling prices, 3) payments to the sellers upon completion...

Do the seller’s get an incentive? YES. HAFA will provide sellers up to $3000 for Relocation Assistance if they complete the HAFA short sale or deed in lieu process. Only one payment per household is given.

Who completes the Short Sale Agreement ?

This form is completed in cooperation with the listing agent so that the servicer knows that the agent agrees to the HAFA program terms and conditions.

Are their tax and credit consequences from a HAFA short sale or deed-in-lieu?

The difference between the remaining amount of principal owed and the amount that the servicer receives from the sale must be reported to the Internal Revenue Service (IRS) on Form 1099C. It will be reported as debt forgiveness that could be taxed as income. The $3,000 Borrower Relocation Assistance could also be taxable. Sellers need to be aware of the income tax consequences and/or derogatory impact on credit that may come with a short sale or deed-in-lieu. Sellers should always consult a tax accountant, the IRS and appropriate legal counsel to determine potential liabilities and to explore other options.

CLICK ON THE HAFA BUTTON BELOW TO SEE IF YOU ARE ELIGIBLE TO PARTICIPATE IN THE HAFA PROGRAM

This blog is designed to provide information in regards to the subject matter covered. The Jackson Realty Group Inc, any of its founders, employees, contributors, staff, affiliates are not to be held liable for information shared. Readers are encouraged to verify all information posted and use at their own risk.

7/15/10

Mortgage applications at a 13 year low...so why is that important?

Take a look at this statistic and chart below: The refinance share of mortgage activity remained constant at 78.7 percent of total applications…so, at a 13 year low number, only 21% of the mortgage applications were for new purchases! On an unadjusted basis, the volume of purchase applications is 43% lower than the same week last year!

If even at sub-5% rates buyers are not interested, what’s going to happen to buying interest if (when) rates go up?

- Unemployed people do not buy homes.

- People who have had their hours or salary reduced 20-30% do not buy homes.

- People with a credit score of 599 or less (25% of the population) do not qualify to buy a home.

- People who lost 30% of their home equity can not sell their existing home to buy a new one.

If you’d like to discuss how this all affects your plans to sell or buy, please give me a call on my direct line at 561-602-1258.

Thanks for reading,

Steve Jackson

7/4/10

A 4th of July gift for you...

Below I have given you 4 links to 4 very important documents.

Why not get the family/friends together and read and discuss what is actually behind this holiday. Certainly not all 4 at once...but maybe read the short Declaration of Independence before everyone starts dinner?

Enjoy the holiday...and be safe!

Steve Jackson

7/1/10

Disastrous home sales report - July 1, 2010

The experts expected home sales to drop once the homebuyer tax credit lapsed at the end of April, but the depth of the decrease was shocking (only to the “experts”).

According to the National Association of Realtors (NAR), pending home sales fell a whopping 30% in May. Their index, which measures signed sales contracts but not closed sales, plunged to 77.6 from 110.9 in April. It's even off 15.9% from a year ago when the nation was barely emerging from the recession.

The pending home sales report is a disaster," said Mike Larson, a real estate analyst for Weiss Research. "Sales fell off a cliff after the tax credit expired. It's the biggest monthly decline ever and the index is at its lowest level since NAR began tracking it in 2001."

(As expected)…Lawrence Yun, NAR's chief economist, downplayed the damage a bit. According to him, customers rushed into deals to claim the credit, borrowing from May sales. Once the economic recovery comes into full swing, housing markets will heat up. "If jobs come back as expected, the pace of home sales should pick up later this year," said Yun, "and reach a sustainable level of activity given very favorable affordability conditions."

The question is when -- or if -- the job market will ever bounce back.

"We're not creating jobs," said Larson. "The housing problems now are being driven by broad economic problems."

Senate Passes Homebuyer Tax Credit Extension « HousingWire

Wednesday, June 30th, 2010, 11:34 pm

Yesterday, the House pushed through a three month closing extension of the homebuyer tax credit.

Tonight, the Senate unanimously approved the bill — leaving the President to ratify the provision by signing it into law, as early as tomorrow morning.

"I thank my colleagues for joining me to pass this important extension and giving homebuyers in Nevada and around the country the opportunity to purchase their first home," said Sen Harry Reid (D-NV), in a statement following the bill's passage.

"In addition to helping thousands of families experience the American dream, this successful and popular program provides a much needed boost to Nevada's housing market and economy."

The deadline for the tax credit was midnight tonight but only if the mortgage went through, so with Obama's signature, it would have been possible that no contracts currently under offer — but unable to close — would fall through the cracks with the extended deadline.

The Senate approved provision will give buyers until Sept. 30 to complete their purchases and qualify for tax credits of up to $8,000.

If the President signs the bill into law tomorrow, it is unclear if the provision will apply retroactively to deals that close on Thursday, July 1.