6/17/13

6/13/13

Is the “smart money” starting to bail on real estate?

Here are 2 recent headlines relating to the hedge fund investing strategy that has gained popularity in the past few years:

- Is private equity and Wall Street planning their exit from the rental business- Lower yields, IPOs, and packaging deals to sell: The whispers about private equity exiting the rental market are now out in the open. A few reports are highlighting that some private equity investors are testing the waters for an exit via IPOs.

- Housing Bubble II: Euphoria And Other Shenanigans: Private-equity funds have poured tens of billions into gobbling up vacant single-family homes in specific markets. And now some of them are planning IPOs as a way of dumping this stuff into funds that unsuspecting worker bees hold in their 401(k)s. It’s called an exit, and they have to do it before it blows up in their faces.

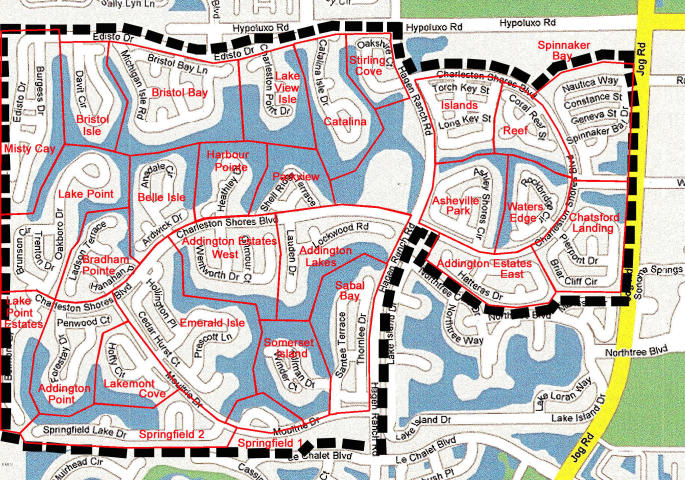

Personally, I just last week saw another agents deal that Blackstone (a very large hedge fund) tried to renegotiate at the last minute…then bailed out on. They had a 3 week to closing date contract on a single family home in Deerfield at $333k and on the final day of their 10 day due diligence period they asked the seller to reduce the price to $300k. Even though the seller had already contracted to purchase another home and packed most of their belongings they counter offered Blackstone at $325k..and Blackstone walked. Was this their normal M.O or are they getting a bit skittish about the rapidly rising home prices in South Florida? Time will tell I guess.

In the past few years institutional investors rushed to buy homes with the philosophy of buy cheap, renovate, and rent. But they might be in for a surprise. According to real estate research firm Trulia Inc., since 2005, there have been almost four million single-family homes added to the rental market. That supply has met the demand created during the crisis in the housing market. (Source: Trulia Inc., April 4, 2013.). Also those numbers do not include the huge rush into the building of multi-family/apartment rentals. With just a simple 15 minute drive around our area you can see hundreds and hundreds of new rental units being built…Cheap corporate money+lots of bad credit/unstable job families=A generation of renters. But the returns projected by these entities, are, in my opinion, much too high.

As a result, the rental rates that institutional investors were banking on (they were working off projections of up to 5% annual rental rate increases) are actually compressing. Recent reports have shown that rental rates are down 1.2% on average in Dade/Broward/Palm Beach counties year over year.

Interest rates have recently spiked to over 4%, which is still historically low, but every tic higher changes the yield for a leveraged investor and reduces the amount any that any buyers who needs a mortgage can qualify for.

Be careful out there.

Thanks for reading…Steve Jackson, 561.602.1258