10/29/11

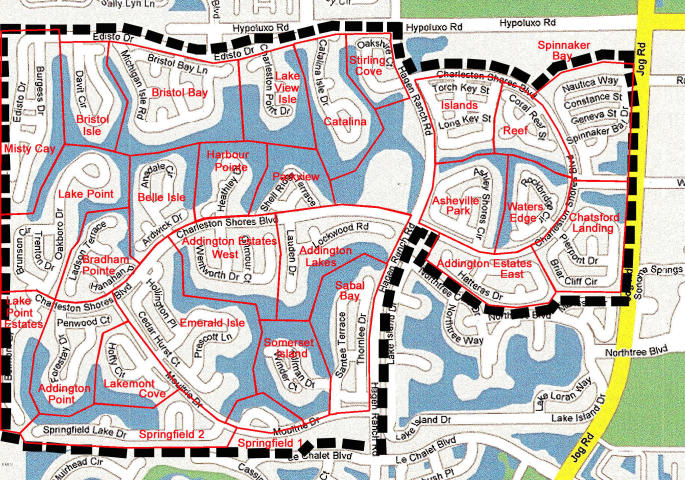

Lake Charleston 2011 sales breakdown

10/22/11

Have a loan with BofA? NOW IS THE TIME TO DO A SHORT SALE!

If you have a loan with BofA and owe more on your loan than your home is worth…DO NOT WAIT…CALL ME TODAY

(you’ll see why below)

Below is a partial screen-shot of an email that I recently received from Bank of America.

They are offering a MINIMUM of $5,000 paid to you, the short sale seller, at closing…and possibly as much as $20,000!

BUT…we only have about 6 weeks to get started.

Really, no kidding…if you have a Bank of America (Countrywide too) loan and are upside down…this is a great opportunity.

My direct # is 561-602-1258…if you reach my voicemail, leave me a message…or you can also send me a text to that number.

Thanks for reading…Steve Jackson

10/20/11

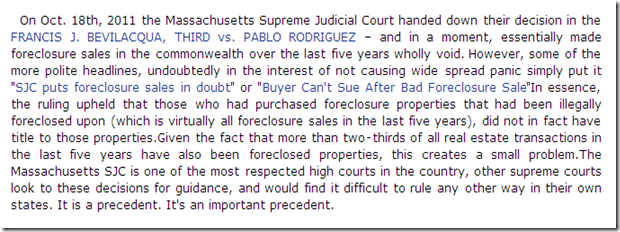

Think buying a bank-owned home is a good deal? Not so fast!

We have always counseled our clients that when buying a bank-owned home there are many pitfalls and caveats...but this Massachusetts court decision casts a very dark shadow on foreclosure sales:

I see many buyers and investors flock to foreclosures because they think that's where the best deals are...but considering the above risk as well as the fact that some of the overall best deals are NOT bank-owned properties..we suggest that our clients consider other options that meet their investment/lifestyle criteria.

Please feel free to call me on my direct line at 561-602-1258 if you have any questions about the above court decision or would like to discuss your investment goals.

Thanks for reading...Steve

10/9/11

Bank Risk Managers: Home Prices Won't Recover Until 2020

An interview of bank risk managers by Julie Crawshaw this past week on Moneynews.com revealed the sentiment that home prices are unlikely to recover before 2020 and mortgage defaults will persist for years.

“Housing has been an enormous drag on the economy for over three years as U.S. households lost trillions of dollars in equity,” said Dr. Andrew Jennings, chief analytics officer at FICO and head of FICO Labs.

“While the housing sector will almost certainly gain strength during the next nine years, many bankers clearly believe prices will remain depressed for half a generation." "This puts the devastation of the housing crash into perspective.”

Among bankers surveyed, 49 percent said that recovery would not occur until 2020 and 73 percent believed mortgage defaults would remain elevated for at least five more years.

Furthermore, 46 percent of respondents expected mortgage delinquencies to increase over the next six months, and only 15 percent of respondents believed mortgage delinquencies will decline during that period. Only 15 percent of respondents expect mortgage delinquencies to decline during that period.

Housing prices nationwide could keep falling and might not bottom out for years, says Yale Professor and housing expert Robert Shiller.

In February, Shiller said housing prices could still fall 10 percent to 25 percent in real terms before hitting bottom. He recently told Yahoo’s The Daily Ticker he's standing by the prediction, adding that the economic big picture is looking worse. "I think the economic situation looks more precarious now," says Shiller, one of the authors of the S&P Case-Shiller Home Price Index, which was down 4.1 percent year-on-year in July although up from previous months earlier this year.

My comments: These type of stories always intrigue me for the sheer fact of how superficial and incomplete reporting has become. The sentiment is interesting and accurate, on the surface. However, one of the most important details; What is the risk managers definition of “recovery”, was omitted. Does “recovery” mean that prices will regain the highs of 2005? Does it mean simply that 2020 is when they think prices will stop declining and resume a historical rate of modest appreciation?

And housing is inherently local in nature…while some markets may not “recover” until well after 2020…some have already neared a bottom.

Here in Palm Beach County, with about 50% of all homes with mortgages already in a negative equity position (under water) and a non-existent job recovery, wed are going to have continued mortgage defaults and distressed sales (short sales and bank-owned sales)…which will, in turn, continue the cycle of increasing the percentage of properties in a negative equity position and increasing the probability of further defaults.

I can guarantee, unless we have serious inflation, that 2020 will NOT bring back the good old days of 2005…and inflation may not even accomplish it without serious and stable job growth.

Thanks for reading…Steve Jackson

10/4/11

Strategic default OK for Mortgage Bankers Association…but not for you?

The article below is from a recent post on the Mortgage-Mod_Monster blog:

Again we read the guilt trip that the mortgage industry places on distressed homeowners when dealing with their distressed mortgage. But it’s OK and even advisable for the corporations to walk away from their obligations. I’ve written about this before, but when the Mortgage Banker’s Association double deals, this is just too juicy to not publicize.

Again we read the guilt trip that the mortgage industry places on distressed homeowners when dealing with their distressed mortgage. But it’s OK and even advisable for the corporations to walk away from their obligations. I’ve written about this before, but when the Mortgage Banker’s Association double deals, this is just too juicy to not publicize.

Freely quoting from Mandelman’s post: “The CEO of the powerful Mortgage Bankers Association, John Courson, has said that underwater borrowers should keep paying on their mortgage loans and ‘should not walk away from lawful debts’. In an interview this past year, Courson appeared genuinely concerned adding: ‘What about the message they will send to their family and their kids and their friends?’

Just last year, you pointed out that defaults hurt neighborhoods by lowering property values, so borrowers would do less harm to our society were they just to repay what they owe. You know… like the responsible homeowners.

This past week, the Co-Star Group, Inc., indicated that it had agreed to buy the MBA’s 10-story headquarters building in DC for $41.3 million. The only problem is that $41.3 million comes up a skosh shy of the $75 million first mortgage on the building that the MBA took out from PNC Financial Group way back in 2007, when they purchased the property for $79 million.

The very same MBA also defaulted on their payments and secured a forbearance agreement, prior to the short sale. Nicely done, Johnny-O.

What kind of message are YOU now sending to Your family, Your children, and Your friends by walking away from Your lawful $75 million debt? Are they being morally harmed by your decision to stick the bank with close to $25 million? And why aren’t You simply paying Your mortgage as agreed, Mr. Courson?

Again, advice to the distressed homeowner: Answer the emotional question first – do you want to keep your house? or walk away with the least damage and purchase another home in two years? Then consider the financial questions. Do you have steady, although significantly reduced employment that you can count on for the foreseeable future? Do you believe your property recover any lost value in 5 to nine years?

Currently, the best answer to solving a distressed mortgage is the REST Report. The REST Report calculates Net Present Value and enables a distressed mortgage owner to negotiate an unbiased mortgage modification with court support if the mortgage servicer chooses to ignore the calculations and pursue foreclosure…

If you don’t believe your property can recover value in 5 to nine years, give the keys back to the bank…It even now has a name, compliments of firms like the Mortgage Banker’s Association. It’s called a ‘strategic default’. Do not even consider for one minute any ethical responsibility to anyone but yourself. Your bank cares not one whit for your well-being. You owe them, or anyone else, not one red cent.