- Anadale - 3

- Ansley - 2

- Anson - 1

- Ashley Shores - 9

- Atwood - 1

- Audrey - 2

- Belmont - 2

- Briar Cliff - 5

- Bristol Bay - 2

- Brunson - 4

- Bryson - 1

- Burgess - 9

- Catalina Way - 3

- Catalina Club - 1

- Catalina Isle - 3

- Cedar Hurst - 5

- Charleston Point - 7

- Chicora - 1

- Davit - 5

- Duncrest - 1

- Edisto - 5

- Forestay - 1

- Geneva Lakes - 1

- Gilmore - 1

- Hatteras - 1

- Heathley - 2

- Heavener - 1

- Highsmith - 1

- Hoffy - 3

- Hollington - 2

- La Rose - 2

- Lake Placid - 1

- Lakewood Cove - 6

- Michigan Isle - 4

- Nolting - 2

- Oakboro - 9

- Pierpont - 3

- Prescott - 5

- Rockbridge - 4

- Santee - 5

- Shell Ridge - 3

- Springfield Lake - 11

- Taylorwood - 1

- Thornlee - 5

- Tillman - 2

- Trenton - 3

- Trescott - 2

- Wescott - 5

- Winder - 2

6/22/10

Foreclosures in Lake Charleston

6/20/10

6/10/10

Animal House, Belushi and Housing?

- Stan Humphries, chief economist of Zillow: “Most consumers tend to be overly optimistic about what the future holds,”..."the housing recession is not over, prices are continuing to fall"..."We think the bottom is going to be a long and flat affair"...“Foreclosures are increasing and we will reach a peak in foreclosures later this year. These foreclosure rates won’t recede quickly. They’ll stay high.” ...referencing the recently expired tax credits, he said “We will see payback in July and August,”..."as long as unemployment is extremely high (8 percent to 10 percent, or higher), and large numbers of homeowners (23.3 percent) are underwater (almost 49% of all mortgage holders in Florida), foreclosures will stay high. Also, there are as many as 7 to 8 million housing units in the “shadow inventory,” many of which will turn into foreclosures as well... there are also 5.3 million “sideline sellers” just waiting to jump into the market and list their properties..."If you really want to know when the housing market will return to normal, the real estate experts and economics at my conference are talking about 2013 – or longer".

- This from the 'always optimistic' National Association of Realtors: Twice as many homes were added to the market as were sold in April, according to the National Association of Realtors...the housing inventory is back to where it was in 2009, which is lousy news for home price appreciation.

- Michael Fratantoni, the Mortgage Bankers Association’s vice president of research and economics: "Overall mortgage application volume, which includes loans for purchases and refinancings, dropped by 12.2 percent during the week ending June 4, compared with the previous week...“Purchase applications are now 35 percent below their level of four weeks ago, as homebuyers have not returned to the market following the expiration of the homebuyer tax credit at the end of April".

- James J. Saccacio, CEO of RealtyTrac: "The numbers in May continued and confirmed the trends we noticed in April: overall foreclosure activity leveling off while lenders work through the backlog of distressed properties that have built up over the past 20 months. Defaults and scheduled auctions combined increased by 28 percent from 2007 to 2008 and another 32 percent from 2008 to 2009 — creating a build-up of delayed bank repossessions. Lenders appear to be ramping up the pace of completing those forestalled foreclosures even while the inflow of delinquencies into the foreclosure process has slowed.” This is precisely the event that CNBC's Diana Olick was warning about a month ago. Housing is about to take fresh new turn lower.

- Michael Pento, Chief Economist for Delta Global Advisors: "We need to sell assets, and we need to allow the deleveraging process to consummate. We are going in a wrong direction and that's the double dip recession is virtually assured. 2008 taught us very clearly that decoupling is a dodo bird's philosophy. The US is headed down. You'll see home starts, permits, sales plummet in the next few months, that's going to add more supply to the housing market..."

As always...thanks for reading.

Steve Jackson

6/6/10

Lake Charleston Sales, the past 30 days...and some analysis

- 7517 Edisto: Sold @ $130k...short sale

- 7529 Edisto: Sold @ $135k...bank owned

- 7481 Edisto: Sold @ $147...traditional sale

- 7409 Shell Ridge: Sold @ $158k...bank owned

- 6864 Torch Key: Sold @ $161k...short sale

- 7980 Lakewood Cove: Sold @ $169k...short sale

- 7630 Bristol Bay: Sold @ $184k...traditional sale

- 7878 Springfield: Sold @ $186k...bank owned

- 6801 Torch Key: Sold @ $198k...traditional sale

- 7708 Oakboro: Sold @ $210k...short sale

- 7071 Davit: Sold @ $215k...traditional sale

- 7227 Davit: Sold @ $242k...traditional sale

- 7366 Shell Ridge: Sold @ $252k...traditional sale

- 7759 Cedarhurst: Sold @ $325k...traditional sale

As always, thanks for taking the time to read our blog.

Steve and Jackie Jackson

6/1/10

What is everyone searching for?

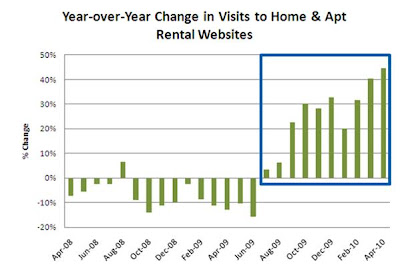

People will choose to rent for 2 main reasons...they can't buy a home or they don't want to buy a home.

A large number of people today who CAN'T buy fall into a two categories: 1) No job/job or income instability, 2) credit issues. Hopefully, the job situation will improve consistently going forward, but the number of people with credit issues will most likely continue to rise. Think about the statistic in this following chart: (look at the very left bar in the graph)

The state with the greatest percentage of people at least 30 days late on their mortgage is...FLORIDA! Over 1 out of every 4 people with a mortgage is 30 or more days behind.

It is common knowledge that missing mortgage payments will deliver a pretty significant hit to ones credit score. And with the abject failure of the Govt. HAMP (loan modification) program, it is a fairly safe bet that a large number of people currently behind on their mortgage will end up eventually either losing their home in a foreclosure action or successfully completing a short sale (the much better alternative). In either case, these folks will not be purchasing a homeduring the next 2 years, or more. These are ones who can't buy a home.

Then you have large segment who still believe that it is not a good time to buy..they are renters by choice, and their numbers are growing daily.

Now, I personally know that many investors are plowing money into the real estate market, although they are very selective and are making decisions that factor in NO appreciation for 5 or more years. And, there are still buyers out there. They are balancing the historically low interest rates, low home prices and reduced competition against the chance that home values will decline further. But most of my buyers today have a long enough time horizon to give them the confidence that the combo of interest rate and home prices makes it a good time to buy.

Any homeowners reading this who are considering moving in the next 24 months or so should seriously consider getting your home on the market sooner, rather than later. Sell, get you money in the bank now, and rent for a while if you need to. It may be a bit inconvenient, but it appears that this may be the smartest move.

5/25/10

Lake Charleston homes in foreclosure

Below is a breakdown by street, alphabetically:

- Anadale-3

- Ansley-2

- Anson-1

- Ashley Shores-10

- Atwood-1

- Audrey-2

- Barrier Reef-1

- Belmont-2

- Big Pine-3

- Briar Cliff-5

- Bristol Bay-2

- Brunson-4

- Bryson-1

- Burgess-9

- Catalina Way-3

- Catalina Club-1

- Catalina Isle-3

- Cedar Hurst-5

- Charleston Point-5

- Chicora-1

- Coppitt Key-1

- Coral Reef-3

- Crawl Key-1

- Davit-4

- Duncrest-1

- Edisto-5

- Forestay-1

- Geneva Lakes-1

- Gilmour-1

- Hatteras-1

- Heathley-2

- Heavener-1

- Highsmith-1

- Hoffy-3

- Hollington-2

- Key Largo-1

- La Rose-3

- Lake Placid-1

- Lakewood Cove-7

- Long Key-3

- Michigan Isle-4

- Nolting-2

- Oakboro-10

- Oakshire-1

- Pierpont-3

- Pigeon Key-2

- Prescott-5

- Red Reef-4

- Rockbridge-4

- Santee-5

- Shell Ridge-4

- Springfield Lake-10

- Sugarloaf Key-3

- Taylorwood-1

- Thornlee-5

- Tillman-2

- Torch Key-7

- Trenton-3

- Trescott-2

- Wescott-5

- Winder-2

Steve Jackson

Falling home prices raise fears of new bottom - Yahoo! News

Tax credits and historically low mortgage rates have failed to lift home prices so far this year. Prices fell 0.5 percent in March from February, according to the Standard & Poor's/Case-Shiller 20-city index released Tuesday .

The co-creator of the Case-Shiller index, who predicted in 2005 that the housing bubble would burst, is raising concerns that the worst may be ahead. That fear is shared by other economists who point to weak job growth, tight credit and many more foreclosures ahead.

"I'm worried still about the risk of a double-dip," economist Robert Shiller said in an interview.

The month-to-month drop from February to March marked the sixth straight decline. Prices in 13 of the cities fell. Only six metro areas recorded price gains. One, Boston, came in flat.

In the first quarter of 2010, U.S. home prices fell 3.2 percent compared with the fourth quarter.

5/13/10

RISMEDIA, May 13, 2010—With short sales making up almost 35% of home sales in March and the country with a national foreclosure problem, I Short Sale, Inc., one of the largest short sale firms in the U.S., sets the record straight on common short sale myths.

1. You must be default on your mortgage to negotiate a short sale. Short sales are not a function of default status on a mortgage. They are the result of the bank mitigating a potential default situation that, in the long run, will cost more money to the investors. We have completed many short sales in instances when the borrower was not in a default situation.

2. Listing my home as a short sale is embarrassing. Anytime we get ourselves into a tough financial situation it can cause some embarrassing feelings. It is important to remember that those feelings will not help us get back onto stable financial ground. We need to overcome our feelings and do what is right to protect our financial futures.

3. Buyers aren't interested in short sale properties. Short Sale properties are often times available at a competitive price to other properties on the market. In many cases, short sale properties are very well cared for and have not had to endure the deferred maintenance of a REO property. Short Sale properties are in great demand in the marketplace.

4. There's not enough time to negotiate a short sale before foreclosure. A good negotiator takes into account the timeline affiliated with a foreclosure. There is always a chance that a short sale can be negotiated. However, the only way to know for sure is to try.

5. The bank would rather foreclose than complete a short sale. Banks do not want to foreclose on property. It is expensive and carries a high level of liability once the bank owns that property as an REO. Wherever possible, banks are seeking other loss mitigation options before foreclosure.

6. Short sales are impossible and never get approved. Short sales are complicated, but not impossible. We negotiate short sale approvals every day.

5/9/10

Lake Charleston market activity...on the market

They range in price from $140k on Burgess, to $370k on Thornlee.

6 are being marketed as short sales.

2 are bank-owned sales

The asking price per sq ft ranges from $94 to $148

The days on the market range from 5 to 659 (for the $370k home)

Below is the asking price distribution