The article below is from a recent post on the Mortgage-Mod_Monster blog:

Freely quoting from Mandelman’s post: “The CEO of the powerful Mortgage Bankers Association, John Courson, has said that underwater borrowers should keep paying on their mortgage loans and ‘should not walk away from lawful debts’. In an interview this past year, Courson appeared genuinely concerned adding: ‘What about the message they will send to their family and their kids and their friends?’

Just last year, you pointed out that defaults hurt neighborhoods by lowering property values, so borrowers would do less harm to our society were they just to repay what they owe. You know… like the responsible homeowners.

This past week, the Co-Star Group, Inc., indicated that it had agreed to buy the MBA’s 10-story headquarters building in DC for $41.3 million. The only problem is that $41.3 million comes up a skosh shy of the $75 million first mortgage on the building that the MBA took out from PNC Financial Group way back in 2007, when they purchased the property for $79 million.

The very same MBA also defaulted on their payments and secured a forbearance agreement, prior to the short sale. Nicely done, Johnny-O.

What kind of message are YOU now sending to Your family, Your children, and Your friends by walking away from Your lawful $75 million debt? Are they being morally harmed by your decision to stick the bank with close to $25 million? And why aren’t You simply paying Your mortgage as agreed, Mr. Courson?

Again, advice to the distressed homeowner: Answer the emotional question first – do you want to keep your house? or walk away with the least damage and purchase another home in two years? Then consider the financial questions. Do you have steady, although significantly reduced employment that you can count on for the foreseeable future? Do you believe your property recover any lost value in 5 to nine years?

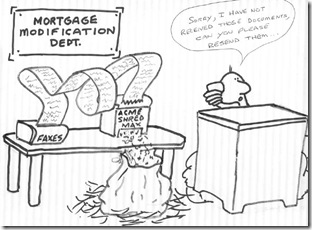

Currently, the best answer to solving a distressed mortgage is the REST Report. The REST Report calculates Net Present Value and enables a distressed mortgage owner to negotiate an unbiased mortgage modification with court support if the mortgage servicer chooses to ignore the calculations and pursue foreclosure…

If you don’t believe your property can recover value in 5 to nine years, give the keys back to the bank…It even now has a name, compliments of firms like the Mortgage Banker’s Association. It’s called a ‘strategic default’. Do not even consider for one minute any ethical responsibility to anyone but yourself. Your bank cares not one whit for your well-being. You owe them, or anyone else, not one red cent.