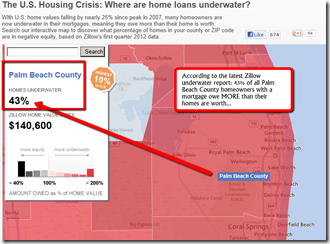

Underwater? Thinking you should pursue a loan modification?

Now, not every loan modification is done this way. In fact, certain mortgage servicers have recently come out with very aggressive loan modification programs that will reduce the principal of the mortgage balance. One of the reasons behind this is the changing of servicing rights; most mortgage holders have probably received a letter at some point telling them that their mortgage was transferred to a new company. Essentially this means that your current mortgage company sold the servicing rights to another company.

Why is the advantageous to you? Because delinquent underwater mortgages have a lesser value than performing mortgages at market value. This means that if the servicer modified your mortgage and you become a paying customer again, you just helped them increase the value of their asset (your mortgage), amazing how that works.

Start by calling your mortgage company and asking them if they have any new mortgage modification programs. And don't be fooled by a company that may want to charge you for this service. They will make the same phone call as you. It all starts with a phone call that you are perfectly capable of making.

So what are the alternatives?

Foreclosure, Deed in lieu, and Short sale.

At the end of the day it seems as if everyone would love to avoid foreclosure. And if you haven't qualified for a loan modification you're only left with a couple of choices. "Deed in Lieu" or "short sale".

Deed in Lieu is where you cooperate with the bank to essentially hand back the keys, transfer title back to the bank. Sounds easy enough but some banks may require you to attempt a short sale first...At this point, the banks don’t want any more homes in their inventory. A deed-in-lieu is basically is a foreclosure that you agree to with the bank, relieving them of the trouble and expense of going through the actual foreclosure

What is a short sale? A short sale is a property that sells for less than the balance owed on the mortgage. The lender accepts a discount on the mortgage to avoid a possible foreclosure auction or bankruptcy. The property would be purchased from a seller with the banks permission.

As you are probably aware short sales have become very common over the past few years and have played a major role in our housing recovery. The main reason is it offers many benefits to both the homeowner and the bank. Foreclosing on a home is timely and costly, so no bank prefers to foreclose, most times, they would much rather use an alternative measure like a short sale. In fact some banks are offering big short sale cash incentives to entice homeowner to list and short sale their property.

Even our Government has stepped in and created a short sale program that if you qualify, it waives any deficiency and also pays relocation assistance money to you at closing to help you get started at a new property. They have also created temporary tax policy until the end of 2012 (which we hope they extend) that again if you qualify, you will not owe any tax on the forgiven mortgage balance.

Given the great current short sale programs that are in place, If have you think that you may be a candidate for a short sale, now may be the time.