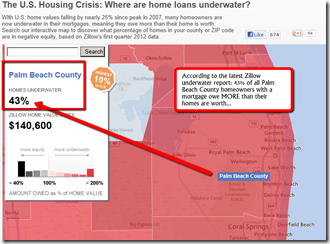

It’s all over the news…The housing crisis is over! In todays Palm Beach Post is this headline: Florida home prices bottomed earlier than previously thought, according to one study…and the article goes on to state that they just realized that the bottom was in 2009!

The bottom has been reached and it’s all up from here…Green shoots are everywhere!

Not so fast…There’s a good chance those green shoots will get swamped by the coming wave of distressed home sales!

I have been following (and charting…see below) the number of Lis Pendens filed with the Palm Beach County Clerk since 2010.

Here’s another tidbit from a recent Sun Sentinel article: It takes an average of 861 days for a lender to repossess a property in Florida, says RealtyTrac Inc., a California foreclosure listing firm.

Lenders are whole heartedly resuming foreclosures following the “robosigning” scandal in which bank employees admitted using faulty paperwork and fake signatures to take back homes.

Prices have rebounded in South Florida and across the state in recent months. But those gains could easily reverse when the coming wave of foreclosures hits the market.

As we all know by now, bank-owned homes and short sales typically sell for less than a similar home would sell for if not a distressed sale, thereby hurting the values of nearby properties…and specifically creating potential for nightmare scenarios with the appraisals of non-distress-sale homes.

All the recent news stories are reporting that prices are on the upswing and have benefited from a change in the mix of homes sold with distressed properties – bank-owned homes and short sales -- accounting for only 22% of total sales, down from 31% last August.

Below is a graph of the median home price index charting back to January 2008. You’ll see, even with all of the excitement in the media the past few months, that we’re still below summer of 2009 prices. And all the the bumps in prices…they are ALL the summer buying season.

In Quarter one of 2013, when they are charting median sales prices for Oct-Nov-Dec 2012, what do you think the graph will look like?

So, to wrap up this cheery post…my take on all of the recent reports by the experts. They are wrong, period.

If there have been over 10,000 foreclosure actions started so far in 2012, and a total of over 22,000 in the past 20 months and it takes, on average, over 800 days from start to finish, it looks like we are clearly in for a very large number of distressed sales…either as short sales or bank-owned sales.

As of today, there are 11,910 properties listed for sale in Palm Beach County in our MLS system…single family/townhomes and condos. Almost exactly TWICE AS MANY properties have had a foreclosure action initiated since 1/11 than are currently for sale!

Just for fun, lets say that 50% of those in foreclosure somehow resolve the foreclosure. That still leaves over 11,000 short sales or bank-owned homes going to hit the market in the not-to-distant future…and that is just the stats if they stop filing foreclosures today! (which is not going to happen)

The short sales may hit the market sooner, unless the owners are trying to stay as long as possible. But there is no doubt that there will be new downward pressure coming.

For about 6 months now I have been counseling my customers and clients that we are in a ‘mini-bubble’ that may last a few months longer. If you have equity…now may be your best chance for a while to sell.

As always, thank for reading…Steve Jackson…561.602.1258

If you have any comments on this post, or would like to suggest a post topic…send me a text or an email.