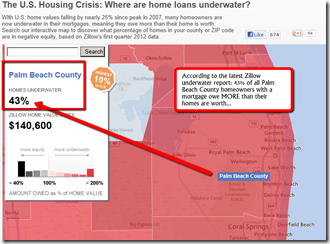

And for upside-down homeowners who have yet to move forward on a short sale…this could spell disaster.

In a short sale, homeowners, and their agents, work with the bank to sell their home for an amount less than their mortgage balance, which allows them to avoid foreclosure. The difference between what they owe and what the bank ‘nets’ on the short sale is commonly referred to as the ‘deficiency’. While the Mortgage Debt Relief Act is in place (until the end of this year), qualifying homeowners can avoid taxes on the forgiven debt (deficiency related to the short sale. This is a huge benefit.

Forgiven debt may be considered income by the IRS and be subject to income tax. For example, if you are upside-down $100,000, the bank may end up with a forgiven deficiency close to $120,000 . If you are in the 20% tax bracket, without the Mortgage Debt Relief Act being in place, you could have a tax liability of $24,000 in the year the deficiency is forgiven!

According to the IRS, “The Mortgage Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief.”

The act has set a deadline of Jan. 31, 2013, for the completions of short sales in order to qualify for the tax relief. Since many short sales take an average of four to eight months to complete, you are quickly are running out of time to initiate and complete your short sale.

Don’t leave this potential huge liability in the hands of the politicians!

Call us today to see how we can help you get out from under. All calls and emails are strictly confidential.

Thanks for reading…Steve Jackson

561-.602.1258 (direct)